ACQUISITIONS

ACQUISITIONS

PURCHASE RATIONALE

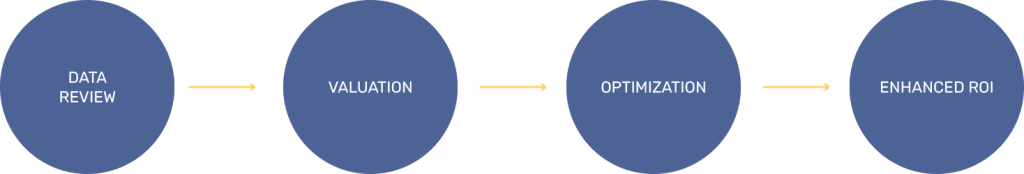

Absolute Resolutions maintains a disciplined approach to purchasing, using tested and proprietary analytics

to evaluate portfolios and optimize recovery.

PURCHASE RATIONALE

Absolute Resolutions maintains a disciplined approach to purchasing, using tested and proprietary analytics

to evaluate portfolios and optimize recovery.

Through our acquisitions program we enable creditors to create immediate cash flow from their receivable portfolios through all stages of the account lifecycle from sub-performing and non-performing segments. We help monetize these segments to establish cash infusion to get you back to running your core business.

Diminish

Your Risk

We’re risk-averse, so your risk is diminished. Let us do the hard work for you. We’re licensed, compliant, and have the structure in place to handle various federal and local regulations. Our experience makes us the preferred accounts receivable management company in the industry.

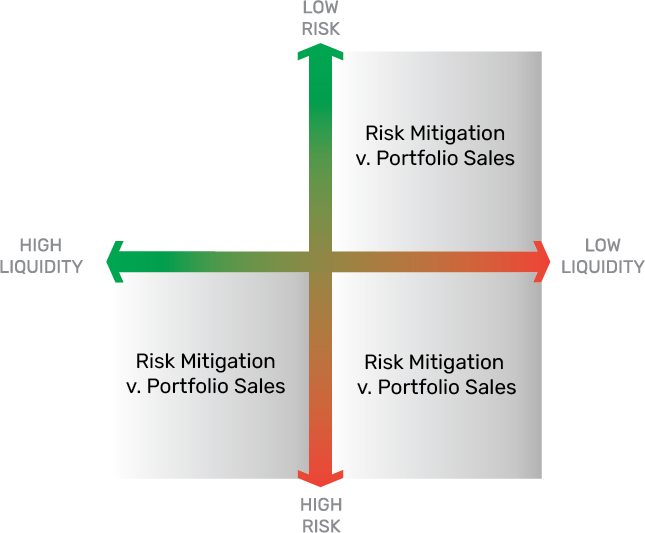

Diminish Your Risk

We’re risk-averse, so your risk is diminished. Let us do the hard work for you. We’re licensed, compliant, and have the structure in place to handle various federal and local regulations. Our experience makes us the preferred accounts receivable management company in the industry.

When your assets become high-risk, or you’re on the edge of low liquidity, let us step in to help liquidate all of the assets and relieve your company of low-performing debt.

We purchase a wide variety of asset classes and regularly acquire the following portfolio types:

We purchase a wide variety of asset classes and regularly acquire the following portfolio types:

SYSTEMS & PROCESSES

The ARC team has established a best in class business model using proprietary systems, processes and cutting edge technology. We have developed sophisticated data analytics tools to help drive decision making. Our extensive portfolio evaluation process along with our intelligent resource allocation maximizes our financial performance while minimizing risk exposure.

Accounts acquired by ARC are serviced through our carefully selected Partner Network. Our industry-leading Compliance Management System includes a comprehensive vendor management program with in-depth oversight into our partner’s operations covering financial controls, regulatory compliance and consumer experience.

PORTFOLIO VALUATION

PORTFOLIO

VALUATION

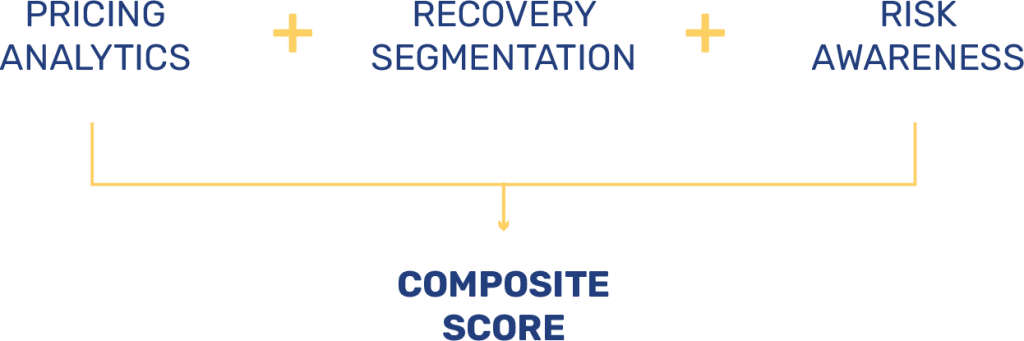

When we evaluate your portfolio valuation, many factors come into play. A few are noted below.

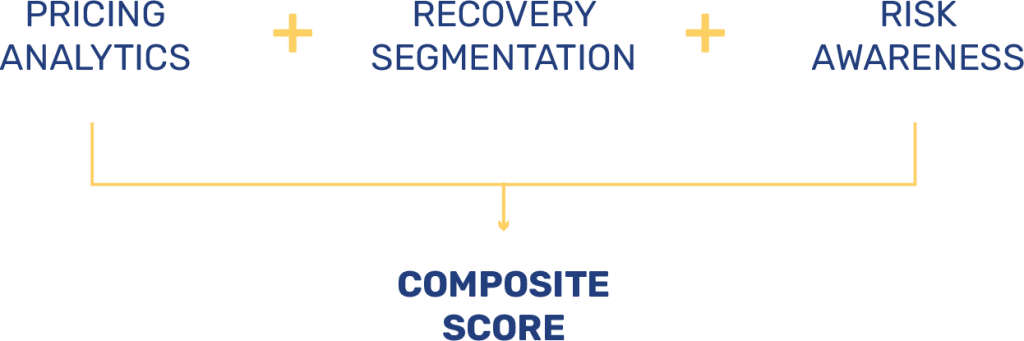

PRICING ANALYTICS – ARC’s proprietary scoring model provides baseline pricing valuation by analyzing key collectability indicators of underlying receivables.

RECOVERY STRATEGY – Pricing analytics are layered into available recovery channels based on product type, aging, balance, proprietary scoring and other account level metrics.

RISK AWARENESS – ARC evaluates portfolios for risk associated with various product types, account metrics and regulatory requirements to determine risk tolerance related to valuation.

COMPOSITE SCORING – Final portfolio valuation combines all of the above plus additional criteria including fit, financial value, partner alignment, contractual terms and regulatory environment.

When we evaluate your portfolio valuation, many factors come into play. A few are noted below.

PRICING ANALYTICS – ARC’s proprietary scoring model provides baseline pricing valuation by analyzing key collectability indicators of underlying receivables.

RECOVERY STRATEGY – Pricing analytics are layered into available recovery channels based on product type, aging, balance, proprietary scoring and other account level metrics.

RISK AWARENESS – ARC evaluates portfolios for risk associated with various product types, account metrics and regulatory requirements to determine risk tolerance related to valuation.

COMPOSITE SCORING – Final portfolio valuation combines all of the above plus additional criteria including fit, financial value, partner alignment, contractual terms and regulatory environment.

Interested in selling your portfolio, and want to learn more about the benefits?

Contact us by filling out the form, and we’ll also send you our whitepaper: Benefits of Selling Low Performing Debt.